Senior Women Web

If You're Looking For A Link To the Mueller Report, Look No Further

Editor's Note:

We're not downloading the entire Mueller report, but here is the Justice Department URL to read the report at:

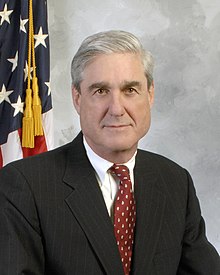

Report On the Investigation Into Russian Interference In The 2016 Election, Vol I and II; Special Counsel Robert S. Mueller, III

https://www.justice.gov/storage/report.pdf?_ga=2.80421777.744576135.1555603755-461170982.1555603755

Mueller received the following military awards and decorations:

|

|

|

|

||||

Kaiser Health News and NPR, Surprise-Billing Law Loophole: When ‘Out of Network’ Doesn’t Quite Mean Out of Network

Kaiser Health News and NPR, Surprise-Billing Law Loophole: When ‘Out of Network’ Doesn’t Quite Mean Out of Network

The Takeaway: More than a year after the federal surprise-billing law took effect, patients can still get hammered by surprise bills resulting from health plans’ limited provider networks and ambiguities about what is considered emergency medical care. The loopholes are out there, and patients ... are just discovering them. Washington state Rep. Marcus Riccelli, chair of the House Health Care and Wellness Committee, said he will ask the state’s public and private insurers what steps they could take to avoid provider network gaps and out-of-network billing surprises like this. He said he will also review whether there is a loophole in state law that needs to be closed by the legislature. Fiedler said policymakers need to consider addressing what looks like a major gap in the new laws protecting consumers from surprise bills, since it’s possible that other insurers across the country have similar contracts with hospitals. “Potentially this is a significant loophole, and it’s not what lawmakers were aiming for,” he said. Congress might have to fix the problem, since the federal agencies that administer the No Surprises Act may not have authority to do anything about it. more »

Jo Freeman Reviews: The Moment: Changemakers on Why and How They Joined the Fight for Social Justice

Jo Freeman Reviews: The Moment: Changemakers on Why and How They Joined the Fight for Social Justice

Jo Freeman Reviews: After publishing his last book in 1921, based on memories and interviews with civil rights icon C.T. Vivian, Steve Fiffer wanted to do more like it. He felt that many lesser-known people had stories that needed to be told. His publisher concurred. It does help to start with an interested publisher. At that time it was NewSouth books. By the time the book came out in November 2022, NewSouth had become an imprint of the University of Georgia Press.

more »

Kaiser Health News*: May 11th Era of ‘Free’ Covid Vaccines, Test Kits, and Treatments Is Ending. Who Will Pay the Tab Now?

Kaiser Health News*: May 11th Era of ‘Free’ Covid Vaccines, Test Kits, and Treatments Is Ending. Who Will Pay the Tab Now?

"Medicare beneficiaries, those enrolled in Medicaid — the state-federal health insurance program for people with low incomes — and people with" Affordable Care Act coverage will continue to get Covid vaccines without cost sharing, even when the public health emergency ends and the government-purchased vaccines run out. Many people with job-based insurance will also likely not face copayments for vaccines, unless they go out of network for their vaccinations. People with limited-benefit or short-term insurance policies might have to pay for all or part of their vaccinations. And people who don’t have insurance will need to either pay the full cost out-of-pocket or seek no- or low-cost vaccinations from community clinics or other providers. If they cannot find a free or low-cost option, some uninsured patients may be forced to skip vaccinations or testing." more »

Congressional Budget Office: Federal Budget Deficit Totals $1.4 Trillion in 2023; Annual Deficits Average $2.0 Trillion Over the 2024–2033 Period

Congressional Budget Office: Federal Budget Deficit Totals $1.4 Trillion in 2023; Annual Deficits Average $2.0 Trillion Over the 2024–2033 Period

"The cumulative deficit over the 2023–2032 period that we now project is $3 trillion larger than we projected last May, mainly because of newly enacted legislation and changes to the economic forecast that boost interest costs and spending on mandatory programs. Federal debt held by the public is projected to rise from 98 percent of GDP in 2023 to 118 percent in 2033 — an average increase of 2 percentage points per year. Over that period, the growth of interest costs and mandatory spending outpaces the growth of revenues and the economy, driving up debt. Those factors persist beyond 2033, pushing federal debt higher still, to 195 percent of GDP in 2053. The increase in mandatory spending is driven by rising costs for Social Security and Medicare. Total discretionary spending falls in relation to GDP. As the cost of financing the nation’s debt grows, net outlays for interest increase substantially." more »