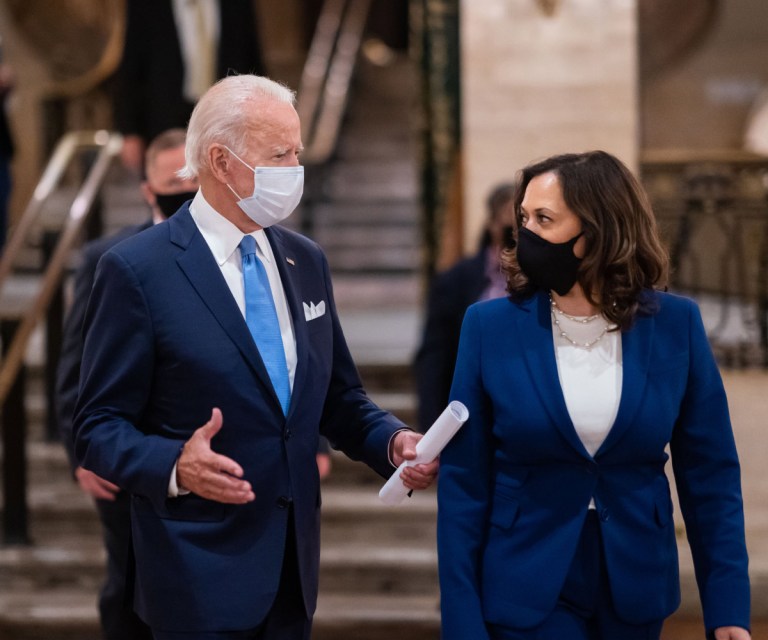

The Biden-Harris Administration is Taking Action on Junk Fees that Hurt Americans’ Pocketbooks and the Economy

By: Brian Deese, Neale Mahoney, Tim Wu

Last month, at a meeting of the White House Competition Council, President Biden called on all agencies to reduce or eliminate hidden fees, charges, and add-ons for everything from banking services to cable and internet bills to airline and concert tickets.

These so called “junk fees” are not just an irritant – they can weaken market competition, raise costs for consumers and businesses, and hit the most vulnerable Americans the hardest.

Today, the Consumer Financial Protection Bureau (CFPB) took new actions to effectively eliminate billions in banking fees – building on other Biden-Harris Administration actions that are already saving consumers billions more.

On the occasion of today’s announcement, this blog provides context on what junk fees are, why they are a concern, and what the Biden-Harris Administration is doing to address them.

Defining “junk” fees

There is nothing wrong with a firm charging reasonable add-on fees for additional products or services. In the interests of customization, firms should be free to charge more to add mushrooms to your pizza or to upgrade you to a hotel room with an ocean view. However, in recent years we’ve seen a proliferation of “junk fees” – a category of fees that serve a different purpose. They can be defined as fees designed either to confuse or deceive consumers or to take advantage of lock-in or other forms of situational market power.[1]

Academic research and agency experience suggest the following fees and fee practices fall within this category:

- Mandatory fees that often hide the full price. Some sellers publish a low price and then add mandatory fees later, at the “back-end” of the buying process or when a consumer tries to terminate the service. As the research shows, by hiding the full price, this practice can lead consumers to pay more than they would otherwise, and it also makes it hard for consumers to comparison shop. An example is the “service fees” added to the cost of a ticket to a concert or sporting event.

- Surprise fees that consumers learn about after purchase. Surprise fees that consumers do not expect – and which may not be mandatory – similarly make it hard to comparison shop and can burden household finances. Surprise hospital bills from out-of-network doctors at in-network hospitals and airline “family seating fees” are prominent examples.

- Exploitative or predatory fees. Excessive fees that target consumers who have limited alternative options – because they are locked into a product or service, or are otherwise economically vulnerable – can likewise impose a financial burden. As the CFPB explains, a sign of exploitative fees is that they “far exceed the marginal cost of the service they purport to cover.” Bank overdraft fees, which greatly exceed the bank’s cost of credit, and surprise “termination fees” are leading examples.

- Fraudulent fees. Some fees involve outright fraud or misrepresentations on the part of the seller. An example is advertising a “no fee” bank account that in practice carries significant fees.

The economic issues with “junk fees”

Markets work when firms compete on an even playing field – displaying prices to consumers in a fair and transparent manner. Mandatory hidden fees risk obscuring the full price, making it harder for consumers to comparison shop – to choose their preferred product and the best deal. These fees can also create an uneven playing field for businesses, making firms that price in a fair and transparent manner seem more expensive than their rivals.

Surprise termination and cancellation fees can harm free and fair competition by increasing switching costs – locking consumers into sub-standard products. Larger switching costs also make it harder for new entrants and more innovative firms to win over market share – reducing market dynamism.

Actions that limit or disallow junk fees have the potential to create more efficient markets by requiring firms to compete on the merits by offering a lower (actual) price or a better product or service. In cases where the junk fee is unjustified, banning the practice outright can reduce firms’ incentives to engage in “exploitative innovation” – developing new junk fees rather than improving the actual quality of the product.