Popular Healthcare Questions Answered: Medicare's New 'What's Covered' App and eMedicare

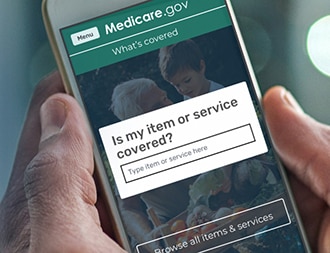

Get Medicare’s new “What’s covered” app!

From Medicare: Not sure if Medicare will cover your medical test or service? Medicare’s free “What’s covered” app delivers accurate cost and coverage information right on your smartphone. Now you can quickly see whether Medicare covers your service in the doctor’s office, the hospital, or anywhere else you use your phone.

“What’s covered” is available for free on both the App Store and Google Play. Search for “What’s covered” or “Medicare” and download the app to your phone. Once “What’s covered” is installed, you can use it to get reliable Medicare information even when you’re offline.

The app delivers general cost, coverage and eligibility details for items and services covered by Medicare Part A and Part B. Search or browse to learn what’s covered and not covered; how and when to get covered benefits; and basic cost information. You can also get a list of covered preventive services.

Easy access to accurate, reliable Medicare coverage information is just one new feature of the eMedicare initiative. To stay up to date on eMedicare improvements and other important news from Medicare, sign up for our email list and follow us on Facebook.

Sincerely,

The Medicare Team

eMedicare – Another step to strengthening Medicare!

You’ve been using technology more and more in your everyday lives. As a result, you have a growing need for fast, easy-to-use, seamless, and personalized experiences online.

eMedicare is here to give you access to accurate and valuable information, presented in ways that make sense. Whether you choose to interact with Medicare online, on the phone, or through other channels, our goal is to make sure you have personalized guidance to make good decisions about your health care and coverage.

To meet these needs and provide the level of customer service that you’ve come to expect, we’re working to update and improve the Medicare resources you know and trust. We’re building these improvements based on data from millions of interactions, feedback that you give us, and targeted research. And as always, we’ll continue to ensure that your personal information is safe and secure.

We’ve already started some of these improvements – have you noticed? If you have or make a personalized account at MyMedicare.gov, and you’ve gotten your new Medicare card in the mail, you can go online anytime to log in and view or print a copy of your card. No more waiting for a replacement in the mail if your Medicare card takes an unexpected turn through the rinse cycle! Also, in your Medicare & You handbook this fall, we’ve included some new charts to give you a simple overview of the types of coverage choices available in Medicare.

These are just a couple of early changes, and there are more on the way. We’re committed to giving you a seamless Medicare experience, whether you’re looking for quick answers online or comparing costs and coverage in different health plan options.

More Articles

- Supreme Court Surprises The Public in LGBTQ Ruling: What is Sex Discrimination?

- US Department of Justice: Leading Cancer Treatment Center Admits to Antitrust Crime and Agrees to Pay $100 Million Criminal Penalty

- Stateline: The Elections Are Coming and There's a National Shortage of Poll Workers

- Pew Trust: Voter Enthusiasm at Record High in Nationalized Midterm Environment

- FactCheck.org Highlights Trump’s Fuzzy Medicare Math, "Medicare will be $700 billion stronger over the next decade thanks to our growth." South Dakota, September 7, 2018

- More Than One-Third of People with Traditional Medicare Spent at Least 20 Percent of Their Total Income on Health Care in 2013

- The Whoppers of 2017: President Trump Monopolizes Fact-Check.org's List of the Year’s Worst Falsehoods and Bogus Claims.

- C-Span Video: Minority Leader Nancy Pelosi, Faith Leaders, Health Advocates Condemn Tax Reform Bill

- About A Third Of Americans Unaware Of Obamacare Open Enrollment

- Trump Executive Order Will Create a Health Insurance Race to the Bottom; Going Back to the Days of Junk Insurance and Insurers That Cannot Pay Claims Hurts Consumers