In States, the Estate Tax Nears Extinction: Countering Arguments That Eliminating the Estate Tax Was a Gift to the Wealthy

For years, the New Jersey Business & Industry Association advocated scrapping the estate tax, arguing it was driving wealthy New Jersey families to other states.

The group got nowhere. Defenders of the tax argued that the cash-strapped state needed every penny it could get and that it was fair to levy an extra tax on the estates of the rich.

Then late last year estate tax opponents finally succeeded: They packaged the eventual abolition of that tax with a bunch of other tax hikes, including a huge increase in the gasoline tax that brought New Jersey from the second-lowest gas tax in the nation to the eighth-highest. Under legislation Republican Gov. Chris Christie signed in 2016, the estate tax exemption rose from $675,000 to $2 million this year and will be eliminated in 2018.

New Jersey will retain its inheritance tax, which is assessed on individual bequests rather than on overall estates.

That's been the pattern in many states that have scrapped the estate tax or increased the amount of the estate that is exempt: By eliminating the estate tax as part of a package that raises revenue from other sources or puts money into other priorities, such proposals have won the support of both Republicans and Democrats.

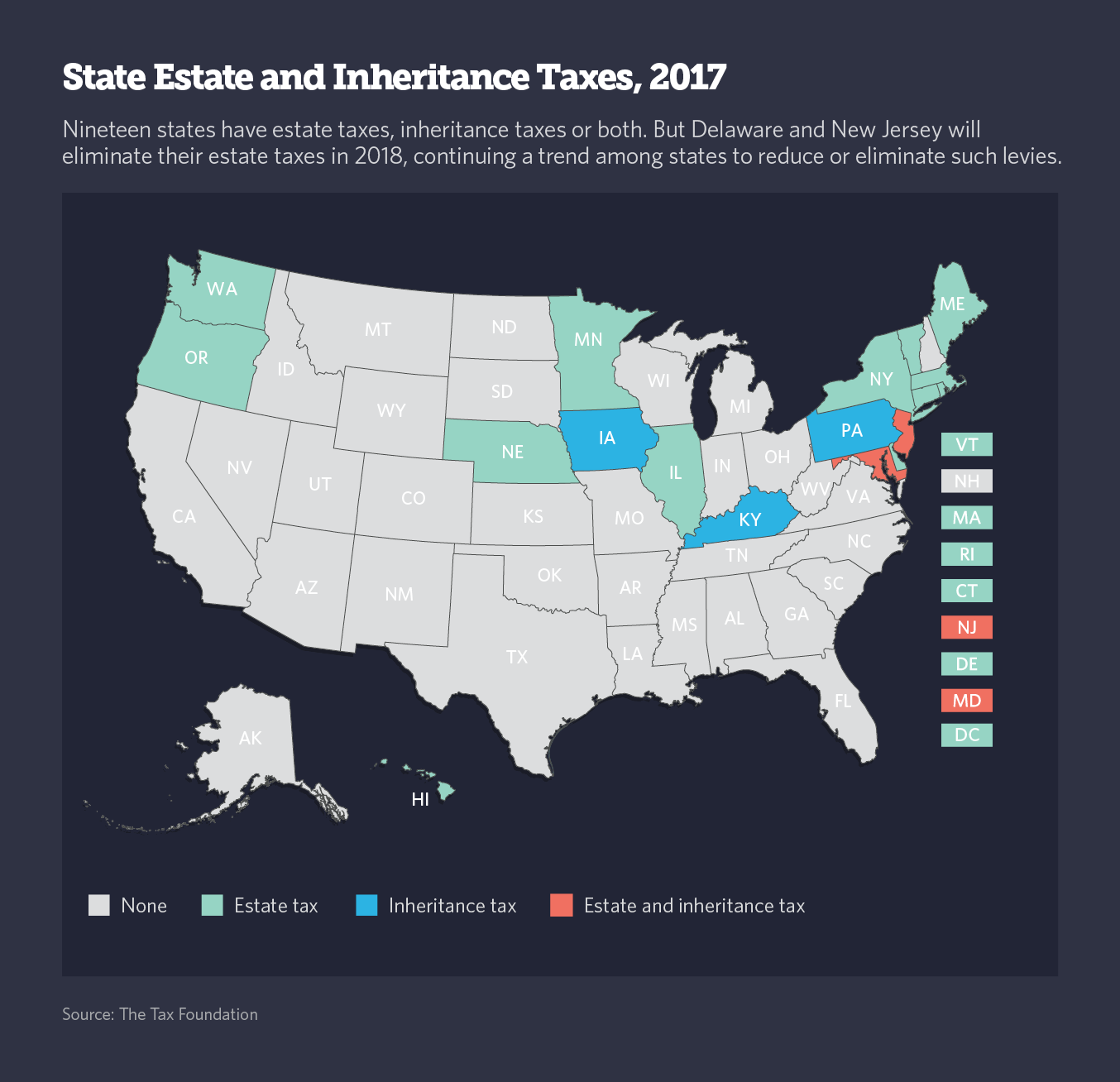

In 2001, every US state imposed either an estate or inheritance tax. But that year, the federal government eliminated its income tax credit for such payments — and the repeals began. By 2018, only 17 states will have an estate tax, an inheritance tax or both.

In recent years, Tennessee (2016), Georgia (2014), Indiana, North Carolina and Ohio (all in 2013) also have eliminated their estate or inheritance taxes.

Earlier this year, Minnesota increased its estate tax exemption from $1.8 million to $2.1 million, retroactive to Jan.1. The exemption increases to $2.4 million in 2018, $2.7 million in 2019, and $3 million in 2020.

Democratic Gov. Mark Dayton, who argued that the state couldn’t afford the loss in revenue, allowed the legislation to become law without his signature. He said that the compromise contained some things that he supported, including child care tax credits, property tax relief for farmers, and increased government aid to cities.

Maryland next year will raise its exemption from $3 million to $4 million, under a 2014 law. Maryland's Senate president, Mike Miller, a Democrat, supported the legislation, though he said he was reluctant to do so. As a tradeoff, he urged the Legislature to raise the minimum wage. It did, and the wage went to $9.25 in 2017.

In DC, the exemption level doubled to $2 million at the start of 2017, and is set to go up to $5.5 million in 2018. The item, which was part of the city’s budget, was made possible by a surplus in revenue. To stave off critics, the council also put more money into school funding and paid leave.

Pages: 1 · 2

More Articles

- Ferida Wolff Writes: This Holiday Season

- Congressional Policy Institute Weekly US Legislative Update, May 17, 2021: Education & Labor; Civil Rights, Education and Labor, Family Support, Expanding Opportunities and Protections for Women and Girls

- New Economic Challenges and the Fed's Monetary Policy Review by Chair of the Federal Reserve Jerome H. Powell

- Ferida Wolff's BackYard: Maple Seeds in Abundance; We Are Birds of a Feather: Is Our Tree of Life Starting to Weaken? It’s a Short Step From Tree-worry to People-worry

- When Your Doctor Is Also A Lobbyist: Inside The War Over Surprise Medical Bills

- Stateline: How One School Is Tackling the Youth Vaping Epidemic

- States Flubbed the Rollout of Their Health Insurance Exchanges. Now They’re Ready to Try Again

- Legislators and Community Leaders Debating Ways to Boost the Number of Children Who Are Up to Date on School-Mandated Vaccinations

- Jo Freeman's Book Review of The Women’s Suffrage Movement by Sally Roesch Wagner

- Stateline: ‘What’s Your Current Salary?’ ‘None of Your Business!’