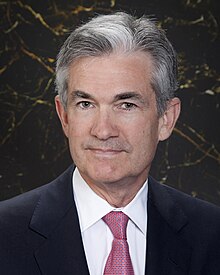

Federal Reserve Chair Jerome Powell Addresses Current Economic Issues: For Some, a Reversal of Economic Fortune

Current Economic Issues, May 13, 2020

Chair Jerome H. Powell

At the Peterson Institute for International Economics, Washington, D.C. (via webcast)

The coronavirus has left a devastating human and economic toll in its wake as it has spread around the globe. This is a worldwide public health crisis, and health-care workers have been the first responders, showing courage and determination and earning our lasting gratitude. So have the legions of other essential workers who put themselves at risk every day on our behalf.

As a nation, we have temporarily withdrawn from many kinds of economic and social activity to help slow the spread of the virus. Some sectors of the economy have been effectively closed since mid-March. People have put their lives and livelihoods on hold, making enormous sacrifices to protect not just their own health and that of their loved ones, but also their neighbors and the broader community. While we are all affected, the burden has fallen most heavily on those least able to bear it.

The scope and speed of this downturn are without modern precedent, significantly worse than any recession since World War II. We are seeing a severe decline in economic activity and in employment, and already the job gains of the past decade have been erased. Since the pandemic arrived in force just two months ago, more than 20 million people have lost their jobs. A Fed survey being released tomorrow reflects findings similar to many others: Among people who were working in February, almost 40 percent of those in households making less than $40,000 a year had lost a job in March.1 This reversal of economic fortune has caused a level of pain that is hard to capture in words, as lives are upended amid great uncertainty about the future.

This downturn is different from those that came before it. Earlier in the post– World War II period, recessions were sometimes linked to a cycle of high inflation followed by Fed tightening.2 The lower inflation levels of recent decades have brought a series of long expansions, often accompanied by the buildup of imbalances over time — asset prices that reached unsupportable levels, for instance, or important sectors of the economy, such as housing, that boomed unsustainably. The current downturn is unique in that it is attributable to the virus and the steps taken to limit its fallout. This time, high inflation was not a problem. There was no economy-threatening bubble to pop and no unsustainable boom to bust. The virus is the cause, not the usual suspects — something worth keeping in mind as we respond.

Today I will briefly discuss the measures taken so far to offset the economic effects of the virus, and the path ahead. Governments around the world have responded quickly with measures to support workers who have lost income and businesses that have either closed or seen a sharp drop in activity. The response here in the United States has been particularly swift and forceful.

To date, Congress has provided roughly $2.9 trillion in fiscal support for households, businesses, health-care providers, and state and local governments — about 14 percent of gross domestic product. While the coronavirus economic shock appears to be the largest on record, the fiscal response has also been the fastest and largest response for any postwar downturn.

At the Fed, we have also acted with unprecedented speed and force. After rapidly cutting the federal funds rate to close to zero, we took a wide array of additional measures to facilitate the flow of credit in the economy, which can be grouped into four areas. First, outright purchases of Treasuries and agency mortgage-backed securities to restore functionality in these critical markets. Second, liquidity and funding measures, including discount window measures, expanded swap lines with foreign central banks, and several facilities with Treasury backing to support smooth functioning in money markets. Third, with additional backing from the Treasury, facilities to more directly support the flow of credit to households, businesses, and state and local governments. And fourth, temporary regulatory adjustments to encourage and allow banks to expand their balance sheets to support their household and business customers.

Pages: 1 · 2

More Articles

- Federal Reserve: Financial Stability in Uncertain Times, A Speech by Governor Michelle W. Bowman

- Jerome Powell's Semiannual Monetary Policy Report; Strong Wage Growth; Inflation, Labor Market, Unemployment, Job Gains, 2 Percent Inflation

- Federal Reserve: Responding to High Inflation, with Some Thoughts on a Soft Landing; What Is Slide Four We Ask?

- The Federal Open Market Committee Statement: The Path of the Economy Continues to Depend On The Course Of The Virus

- Coronavirus Aid, Relief, and Economic Security Act; Chair Jerome H. Powell Before the Committee on Financial Services, House of Representatives

- Federal Reserve: Optimism in the Time of COVID; Businesses Seem Much Better Adapted to Remaining Open

- COVID19 Research Sources From the Federal Reserve Banks Including The Black Death in the Malthusian Economy Article

- A Comprehensive Outreach on Monetary Policy At a Fed Listens Event: "How can we help you better understand our work so you can hold us accountable?"

- The Great Recession: Gen X Rebounds as the Only Generation to Recover the Wealth Lost After the Housing Crash

- GAO: Better Guidance and Information Could Help Plan Participants at Home and Abroad Manage Their Retirement Savings