Fed Reserve Governor Michelle W. Bowman: The Changing Structure of Mortgage Markets and Financial Stability

November 19, 2020

At the “Financial Stability: Stress, Contagion, and Transmission” 2020 Financial Stability Conference hosted by the Federal Reserve Bank of Cleveland and the Office of Financial Research, Cleveland, Ohio

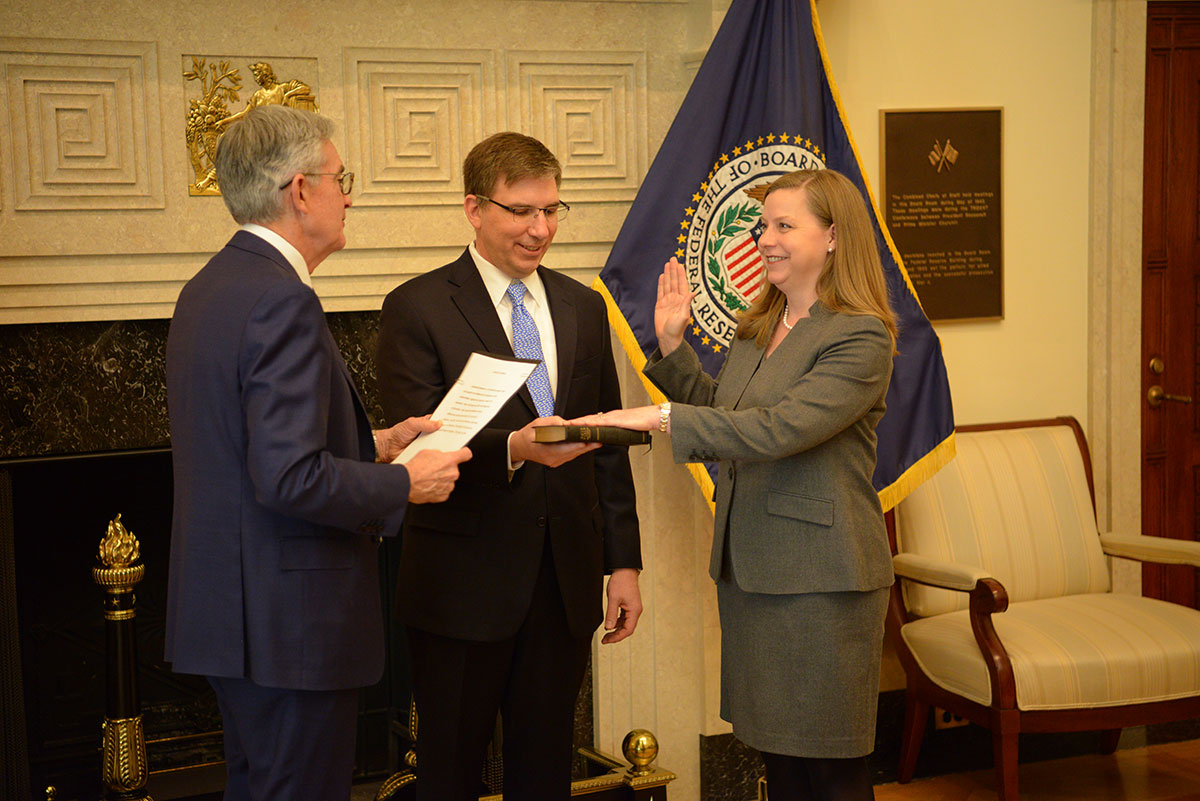

Right, Chair Jerome H. Powell swears in Michelle W. Bowman for her second term, accompanied by Wes Bowman, as a member of the Board of Governors of the Federal Reserve System

It seems especially relevant to look closely at financial stability at this time, as the COVID-19 pandemic has had a profound impact on the US economy and has tested the resilience of our financial system over the past nine months. Efforts to contain the virus triggered an economic downturn that was unprecedented in both its speed and its severity. Early on, more than 22 million jobs were lost in March and April, and though a significant number of people have returned to work since that time, we still face a shortfall in employment relative to its level before the onset of the pandemic.

Fortunately, both our economy and our financial system were very strong when the pandemic hit. Most banks began 2020 with higher capital ratios and more liquid assets than they had in previous downturns, which helped them remain a source of strength in March and April. As the crisis intensified in March, serious cracks emerged in several areas of financial intermediation crucial to the health of the economy, including Treasury markets, corporate and municipal bond markets, money market mutual funds, mortgage real estate investment trusts, and residential mortgage markets. Today I am going to focus on the strains in mortgage markets.

To address strains in mortgage finance, the Federal Reserve took prompt action to purchase large quantities of agency-guaranteed mortgage-backed securities (MBS), because as we learned during the previous financial crisis, the proper functioning of mortgage markets is necessary for monetary policy to support the economy. Unfortunately, the problems in mortgage finance in this crisis were broader than just the MBS markets. This crisis period has also revealed a number of new — or, in some cases, renewed — vulnerabilities related to lending and loan servicing by nonbank mortgage companies, which I will refer to from here on as mortgage companies.

These vulnerabilities were not entirely a surprise to me. When I served as a banker and, subsequently, as the state bank commissioner in Kansas, I saw firsthand the increasing share of mortgage companies in mortgage origination and servicing as well as some of the weaknesses in the mortgage company business model. And in my role as a Board member with a focus on community banks, I frequently hear about the issues that have caused some regional and community bankers to pull back from originating and servicing mortgages. I view this as a significant problem, because I believe firmly that a healthy financial system must have a place for institutions of many different types and sizes that are able to serve the varying needs of different customers.

I will begin today by describing the evolving role of mortgage companies in mortgage markets and the risks to financial stability that activity entails. I will then focus on developments in mortgage markets during the COVID-19 pandemic and discuss how actions by the Federal Reserve and the other parts of the government helped stabilize financial markets and prevent more severe damage to the economy. Finally, I will explain how vulnerabilities associated with mortgage companies could pose risks in the future, and I will review ongoing work across the regulatory agencies to monitor and address these vulnerabilities. I will end by enlisting your help. Figuring out how to achieve a balanced mortgage system — one that delivers the best outcomes for consumers while being sufficiently resilient — is a highly complex task that could benefit from the insights of those of you here today.

The Role of Nonbank Financial Institutions in Mortgage Markets

In the 1980s and 1990s, the share of mortgages originated by mortgage companies increased considerably, as expanded securitization of mortgages allowed mortgage companies, which lack the balance sheet capacity of banks, to compete with banks in the mortgage market. The role of mortgage companies increased further in the 2000s with the growth of the private-label mortgage market, where MBS sponsors are private firms without government support. But the last financial crisis and the prolonged housing slump that followed led to a sharp contraction in mortgage company activity. In 2006, mortgage companies accounted for around 30 percent of originations; by 2008, at the bottom of the housing crisis, this share had fallen to around 20 percent.

In the past few years, the market share of mortgage companies has risen sharply, well surpassing their share before the housing crisis. Today these firms originate about half of all mortgages, including more than 70 percent of those securitized through Ginnie Mae and the government-sponsored enterprises (GSEs) Fannie Mae and Freddie Mac.1 Nonbanks also service roughly three-fourths of mortgages securitized through Ginnie Mae and about one-half of those securitized through the GSEs.2 Although some mortgage companies specialize in origination or servicing, most large firms engage in both activities.

More Articles

- Kaiser Health News: Why Black and Hispanic Seniors Are Left With a Less Powerful Flu Vaccine

- On A Chilly Saturday, Winter Graduates Turn to Their Future: “Some of (your) most important lessons came from a real-life curriculum no one ever anticipated”

- The National Institutes of Health’s Rapid Acceleration of Diagnostics (RADx): When to Test Offers Free Online Tool to Help Individuals Make Informed COVID-19 Testing Decisions

- US Census Report: Young Adults Living Alone Report Anxiety, Depression During Pandemic